Some Known Questions About Lighthouse Wealth Management, A Division Of Ia Private Wealth.

Wiki Article

Indicators on Lighthouse Wealth Management, A Division Of Ia Private Wealth You Need To Know

So, we encourage you to take this initial step discover the advantages of functioning with an economic consultant and see what a difference it makes to have a companion on your monetary trip. A monetary expert can bring you closer to the future you see for on your own in numerous methods from creating personalized savings strategies for all your short- and long-lasting objectives, to picking the best investment products for you, overcoming estate considerations and setting up insurance policy protection for you and your liked ones.

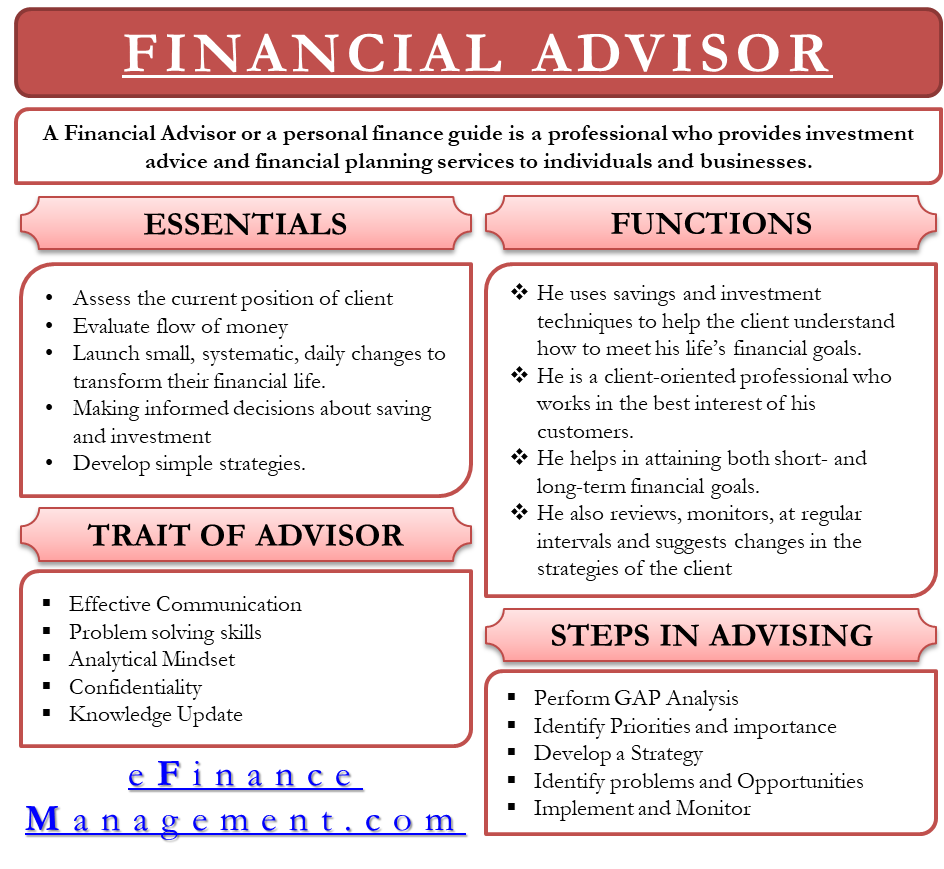

Lots of wonder what an economic advisor does. As a whole, these professionals help you choose concerning what you ought to do with your cash, which might include investments or various other courses of activity. An economic consultant is usually accountable for greater than simply carrying out sell the market on part of their clients.

Together, you and your consultant will certainly cover several topics, consisting of the quantity of money you need to save, the types of accounts you require, the kinds of insurance coverage you should have (consisting of long-term treatment, term life, disability, etc), and estate and tax obligation preparation.

Listed below, discover a listing of the most common services supplied by economic advisors.: An economic expert offers recommendations on financial investments that fit your design, goals, and risk tolerance, creating and adapting investing method as needed.: A monetary advisor produces methods to assist you pay your financial debt and stay clear of financial obligation in the future.: A monetary expert supplies pointers and techniques to produce budgets that aid you meet your goals in the brief and the long term.: Component of a budgeting strategy might consist of approaches that help you spend for greater education.: Likewise, an economic advisor develops a saving strategy crafted to your particular needs as you head into retirement.: A financial expert aids you recognize the people or companies you desire to receive your legacy after you die and produces a strategy to perform your wishes.: A financial consultant offers you with the very best lasting remedies and insurance alternatives that fit your budget.: When it involves tax obligations, a monetary expert may aid you prepare tax returns, make the most of tax obligation reductions so you obtain the most out of the system, timetable tax-loss gathering safety and security sales, make certain the best use the funding gains tax obligation prices, or plan to reduce taxes in retired life.

Getting My Lighthouse Wealth Management, A Division Of Ia Private Wealth To Work

It is essential for you, as the consumer, to recognize what your planner suggests and why. You must not comply with an advisor's referrals unquestioningly; it's your money, and you should understand exactly how it's being deployed. Maintain a close eye on the costs you are payingboth to your expert and for any funds purchased for you.

The average base salary of a monetary expert, according to Certainly. Anyone can deal with an economic advisor at any type of age and at any stage of life. You do not have to have a high net well worth; you simply need to discover a consultant matched to your circumstance. The decision to get specialist assist with your cash is an extremely individual one, however whenever you're feeling overwhelmed, perplexed, emphasized out, or scared by your monetary circumstance may be a good time to look for a monetary advisor.

It's additionally fine to approach an economic expert when you're feeling financially protected however you desire a person to make sure that you get on the right track. An advisor can suggest possible enhancements to your strategy that might assist you accomplish your objectives better. https://canvas.instructure.com/eportfolios/2518588/Home/Lighthouse_Wealth_Management_Navigating_Your_Financial_Horizon_with_Expertise. Lastly, if you do not have the moment or interest to handle your funds, that's another great reason to hire a financial consultant.

Below are some even more specific ones. Since we reside in a world of rising cost of living, any kind of money you maintain in cash or in a low-interest account decreases in worth every year. Investing is the only means to make your cash grow, and unless you have an extremely high income, spending is the only means most individuals will ever before have sufficient money to retire.

The Best Guide To Lighthouse Wealth Management, A Division Of Ia Private Wealth

Generally, spending ought to raise your net worth substantially. If it's not doing that, employing a financial expert can aid you find out what you're doing incorrect and appropriate your program prior to it's far too late (https://www.gaiaonline.com/profiles/lighthousewm/46474113/). A monetary advisor can likewise assist you assembled an estate plan to ensure your assets are taken care of according to your desires after you pass away

Undoubtedly, a fee-only financial consultant may be able to use a less prejudiced viewpoint than an insurance policy representative can. Comply with these basic actions in order to select the ideal economic consultant that supplies approaches and solutions that fit your goals and requirements. Interview a couple of various experts and contrast their solutions, design, and charges.

You want a consultant that is well aware of your threat tolerance and motivates you More Bonuses to take smart choices. A guideline proposed by the Department of Labor (DOL) would have needed all economic experts that function with retirement or provide retirement plan suggestions to supply guidance that remains in the customer's benefit (the fiduciary standard), in contrast to just appropriate for the customer (the suitability requirement).

But in the approximately three-year interval in between Head of state Obama's proposition of the guideline and its ultimate death, the media lost a lot more light than it had previously on the different methods monetary experts function, just how they bill for their services and how the suitability requirement could be much less helpful to customers than the fiduciary requirement - tax planning canada.

Lighthouse Wealth Management, A Division Of Ia Private Wealth Fundamentals Explained

Others, such as licensed economic planners(CFPs), already stuck to this criterion. http://known.schwenzel.de/2015/checked-into-espresto-1#comments. Even under the DOL guideline, the fiduciary standard would not have actually related to non-retirement recommendations. Under the viability criterion, monetary consultants normally deal with compensation for the items they offer to customers. This suggests the client might never ever receive an expense from the economic consultant.

Report this wiki page